The 3D printing space has been a volatile one for investors as of late. We have seen shares of two of the major 3D printing companies, 3D Systems, and Stratasys, drop significantly over the last six months. The cause for the drop in share prices has more to do with technical aspects than with the fundamentals of the companies.

Today Stratasys announced their first quarter earnings, prior to the opening bell. Overall their numbers were solid, better than many analysts had expected. The company generated 54% non-GAAP earnings growth, on a 61% gross margin. The reported net income for the quarter was $4.1 million, or $0.08 per share. This was a nice turnaround from last year when they reported a net loss of $0.40 per share.

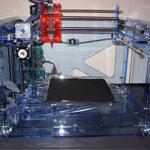

Helped by the acquisition of Makerbot, as well as the launch of their Objet500 Connex3 professional 3D printer, Stratasys sold a total of 8,802 printers, compared to last year’s first quarter where they sold just 1,168 printers.

The CEO of Stratasys, David Reis took part in an earnings call at 8:30 EST this morning, where he talked a little about the progress the company has made over the last three months.

“The rapid adoption of our higher-margin products and services remained impressive during the first quarter, which helped drive strong organic revenue growth of 33% during the period and contributed to a significant increase in our gross margin over last year,” said David Reis, “In addition, MakerBot products revenue remained strong, and we continued to invest aggressively in sales, marketing and product development initiatives that we believe will drive incremental growth over the coming periods. We are very pleased with our first quarter results and we remain on track to meet our financial projections for the year.”

Reis then went on to discuss their recent acquisitions and plans for possible acquisitions in the future.

“We believe the platform created by our pending acquisitions of Solid Concepts and Harvest Technologies will allow us to offer a comprehensive solution for our customers, and will help drive incremental growth opportunities. In addition, we continue to position Stratasys for future growth through enhancements to our organizational structure, and through strategic investments in channel, product and technology development. We believe these investments, combined with our ongoing acquisitions strategy, will support our growth objectives and position of market leadership going forward.”

The company has maintained their outlook for the full year, estimating a total earnings per share of $2.15 to $2.25 for 2014. The stock is down 6.8% on the day, as of the time this story was published. Let’s hear what your opinions of this quarter’s earnings are, at the Stratasys investor forum thread.

When it comes to 3D real estate visualization in the USA, our service provides the perfect solution for bringing property listings to life. Through our platform, you can easily access cutting-edge 3D renderings that showcase your real estate projects in a way that attracts potential buyers and investors. Whether it's residential, commercial, or mixed-use properties, our team of experts uses advanced technology to create immersive visualizations that highlight the best features of your property, making it easier for clients to imagine the space as their own.

Through our website, you can quickly get high-quality 3D real estate visualizations that are tailored to your specific needs. With our help, you'll stand out in the competitive real estate market by offering potential buyers a realistic, interactive view of your property. Our efficient process ensures a fast turnaround time, while our attention to detail guarantees that every aspect of the property is represented accurately, giving you a powerful marketing tool to promote your real estate listings.