Renishaw’s owners have put the metrology and metal printing firm up for sale. With comparatively few powder bed fusion players of note, this is bound to attract some attention. But, for whom would buying Renishaw make sense? We look at some options here.

U.K.-based Renishaw is big in coordinate-measuring machines (CMMs), calibration and measurement tools used for quality assurance, control, and process control. 3D printing is a market where reputation and quality mean something. At the same time, increases in computing power and scanner capability could put long-term pressure on their probe-driven measurement solutions. Simultaneously, data harnessing and management is becoming a software-driven activity which could mean that more value and analysis can be gotten from it or it could mean new competition from people outside the metrology industry. The company also has optical and other encoders using motion control systems used in CMM devices as well as yet another business: metal 3D printing.

In metal printing, Renishaw is a credible player and yet is dwarfed by the likes of EOS, GE and SLM Solutions. With the jump to 9, 10 or 12 lasers, due to the laser wars, machine complexity is increasing significantly as is the investment in a new generation of machines. Additionally, competitors such as Additive Industries, VELO3D, and, one day, Seurat have turned a clubby competitive circle into a free for all.

The opportunities in metal 3D printing are significant and there is limited patent cover for powder bed fusion (PBF). PBF is super complex and requires a lot of experience and human capital to manage well. And, yet, as we’ve seen in the Push Button Metal series, competition is coming in the form of value-engineered devices that skimp on the motion stage, for example, and end up costing much less. More competition is coming through the likes of Farsoon and other Chinese firms, as well. Metal 3D printing was a high art practiced by a guild of skilled fabricators and, now, it’s going to become an MMA cage fight.

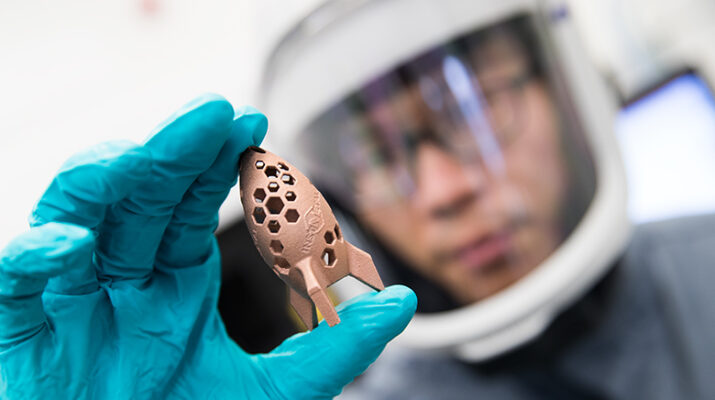

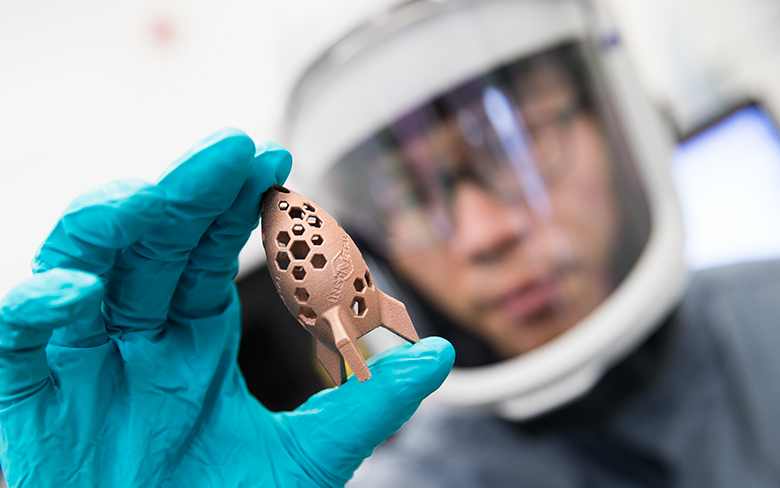

I’m bullish about the long-term prospects of metal printing and, especially, PBF. The technology is increasingly becoming popular in orthopedic implants, where it is an optimal technology at the moment to mimic bone properties and promote growth. At the same time, metal 3D printing is becoming the default technology for critical jet engine components and rocket engines. Optimal results in ICBM’s, missiles, torpedos, satellites, space planes, and hypersonics will define the future of warfare. The ultimate high ground is now being contested not on the battlefield but in metallurgy labs.

The Chinese could negate the power of the U.S. surface Navy if they developed hypersonic torpedos and the U.S. could put a satellite or missile anywhere in a few hours if it mastered the technology. For these platforms, new metals and 3D printing are becoming the default production techniques. I don’t really mind the car industry, but we know that they will complain incessantly about price; the military industrial complex people, not so much. The orthopedics guys? Not at all they just don’t make mistakes and we’re cheaper than the alternatives anyway.

Speaking of orthopedics, Renishaw also sells cranio-maxillofacial (CMF) implants and software for CMF. So, we’ve got a nice little mix of things that are all related and could be set for growth. It’s kind of a Stark Industries starter kit. But, will a broad mix and split R&D budget mean that the company will not have enough heft, capital and inertia to succeed in its many endeavors? Renishaw is a £500 million business, which will make an asset sale limited in the number of partners that can pony up this kind of money. I mean we could be talking about a $5 billion ticket on the firm—on a company that made $300,000 last year…hmmm. So, who has friends in nice places?

GKN Buys Renishaw

From the perspective of the U.K. defense industry, something like this may make sense. BAE Systems could, of course, be a party, as well. This would mean that this strategic technology could stay in the U.K. and be used for U.K.-based defense projects. A new nationalist focus for the country may yet mean that this is more relevant now than it would have been a few years ago.

Previously European countries, including the U.K., would buy kit together and make it together. I’s unclear if or to what extent this will continue. GKN could use Renishaw machines for its automotive and aero business, while now it makes powder, has a 3D printing service, and would make machines via Renishaw. It would let them develop their technology faster and become better at additive than others, but the investment would be considerable and a lot of businesses that would be weird for GKN would then result.

GKN, Nikon, and Johnson & Johnson Buy Renishaw

In this, rather outlandish, scenario, which would only work if their respective CEOs have been playing golf together for a while, GKN would keep the additive manufacturing bit while the metrology division would go to Nikon to be merged with Nikon Metrology. This would expand their offering and make them poised to be the player to integrated metrology into the digital age. Johnson & Johnson would then pick up the orthopedics part of the company and be able to work together with the other acquisition partners on developing integrated manufacturing solutions for orthopedics. This seems a bit complex and difficult to do overall, however.

Rolls Royce PLC Buys Renishaw

It’s a good brand to have on a metrology device, if they continue to carry the division. The company uses an awful lot of metrology as well. It may seem a tad adventurous and away from their engines businesses, but it could actually make sense. Meanwhile, the company could industrialize 3D printing for its own aero-engine components and use 3D printing to optimize its marine propulsion units and other power systems. Weight is critical for these types of machines and, by optimizing flow, the company could make huge strides in optimizing their MTU marine power systems, their nuclear business, and their defense businesses. It would also do the U.K. government “a solid” in keeping a 3D printing technology in the U.K. By having a machine manufacturer it could potentially catch up to GE and their ability to 3D print better aero engines as well.

Zeiss Buys Renishaw

This is a funny one, since Zeiss used to be an important EOS investor. In this scenario Zeiss would expand its reach in metrology and use its knowledge of very different optics to create yet another industrial 3D printing offering from Germany. With $6 billion in revenue itself, this would be a tricky undertaking and need a lot of group hugs from banks. But, it would let Zeiss offer an integrated metrology and manufacturing solution that could take it deeper into the high tech manufacturing world.

Amada Buys Renishaw

For a large machine tool company, Renishaw could also be interesting. Amada could cross-sell metrology equipment to its installed base quite easily. Amada’s cutting tools could work in conjunction with Renishaw output. And Amada’s factory automation business could be used to create a fully automated 3D printing production line. It would be a leap for the firm, but it could then deploy its 3D printing solutions to both existing automation and cutting tool customers.

When it comes to 3D real estate visualization in the USA, our service provides the perfect solution for bringing property listings to life. Through our platform, you can easily access cutting-edge 3D renderings that showcase your real estate projects in a way that attracts potential buyers and investors. Whether it's residential, commercial, or mixed-use properties, our team of experts uses advanced technology to create immersive visualizations that highlight the best features of your property, making it easier for clients to imagine the space as their own.

Through our website, you can quickly get high-quality 3D real estate visualizations that are tailored to your specific needs. With our help, you'll stand out in the competitive real estate market by offering potential buyers a realistic, interactive view of your property. Our efficient process ensures a fast turnaround time, while our attention to detail guarantees that every aspect of the property is represented accurately, giving you a powerful marketing tool to promote your real estate listings.